The Inaccessibility of Attending Out-of-State College

November 14, 2022

As people think about college the looming idea of going out of state becomes more and more appetizing to many. But in the end, how many really make it out of state? Why do many students stay in the state, even though they long for a new adventure elsewhere? Recently the weight of realizing my dream college is likely out of the question because finances have been crushing. This is the reality for many students.

College irregardless is expensive, and many students can’t afford college without the assistance of financial aid, and furthermore, some who have received financial aid cannot afford it. College tuition is a major expense, and that doesn’t include books, rooming situations, transportation, and food expenses.

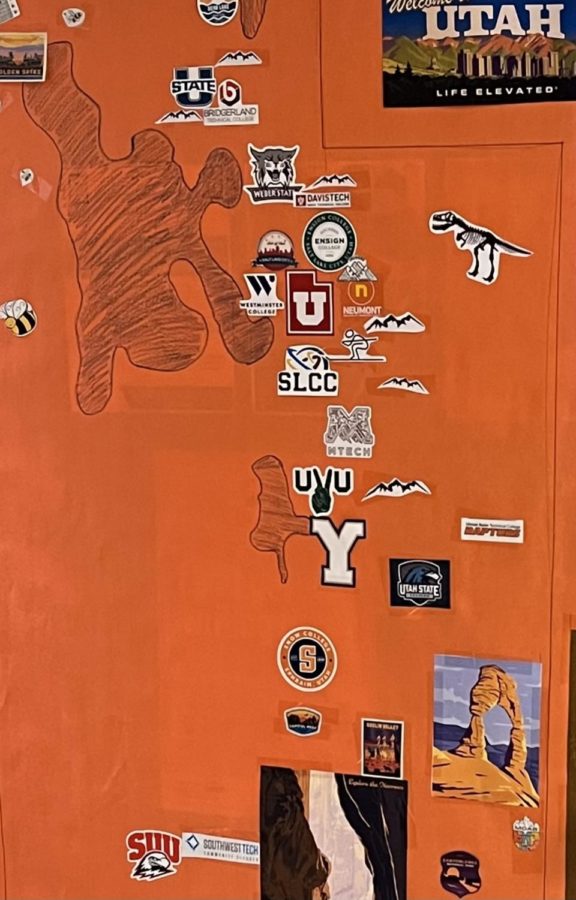

In Utah, students pay about “$6,731 for tuition. That same degree for an out-of-state resident is $21,557,” according to Average In-State vs. Out-of-State Tuition.

Utah has a relatively low cost of tuition as well, so depending on the state costs can easily exceed Utah’s out-of-state costs. There are reasons for the rise in cost, mainly taxes that in-state residents pay. Most public colleges and universities receive funding from the government (that comes from state taxes) to help lower the costs of education for their residents.

While this logic makes sense, I have a hard time fathoming that about fourteen thousand dollars are being contributed to colleges per student from the government. Furthermore, why isn’t there any federal funding to help lower the costs of out-of-state tuition?

If a student is looking for a certain major and none of their in-state colleges offer that degree then they are left with no choice but to look out of state and pay much more for their degree.

Some colleges offer in-state rates for out-of-state students if their ACT/SAT scores are exceedingly high or show other forms of academic promise. To avoid the out-of-state fees people will often take a gap year and live within the state that they intend to attend college in. By being a resident for about a year you will be given in state tuition, as you have been paying taxes to help lower the cost. Scholarships and financial aid are also available to most students who are looking out of state.

Besides those scholarships and aid, some states have formed agreements with each other to lower the cost of tuition for non-resident students. An example in the Western United States is Western Undergraduate Exchange or WUE. On average a student could save anywhere between “$32,600 to $130,600 on tuition during their completion of a program, depending on their field of study” (Average In-State vs Out-of-State Tuition).

Do the costs of out-of-state tuition really outweigh the change of scenery that students desire? After all, will that extra student debt be worth the experience? Oftentimes not, and colleges in-state could still offer freedom, self-expression, and a new life, all for a much cheaper price. After all, we have our lives ahead of us to travel and make new experiences, is the cost of tuition worth it for the thrill of four-plus years?